Do I have to pay VAT?

Why do our prices show VAT?

Normally when you buy something in a shop, the VAT isn’t displayed and isn’t a concern. Printing is a bit different though because we deal with VAT registered businesses, and so we need to show our prices net and inclusive of VAT.

Why do some things have VAT and others don’t?

Printing is quite unusual because the VAT status depends on the form and content of what’s being printed.

The rules are quite complicated though, and this is why we always ask to see the files for every job we quote on.

As a general rule, leaflets, newsletters, booklets and bound documents are zero rated (no VAT), and everything else is standard rated (20% VAT).

However this can become complicated in cases where a zero rated item (eg: a leaflet) could be classed as something different (eg: a voucher).

Some common problems we encounter:

- Leaflets that have forms or questionnaires on them are plus VAT

- Leaflets with discount vouchers or discount codes are plus VAT

- Books of forms are classed as stationery, and are plus VAT

If you place an order for a zero rated product and your file is not suitable, we’ll contact you to request payment for the extra VAT.

We’re legally required to keep tax records of every zero rated item that we print, so there is no way around this unfortunately!

Here are some examples of popular items that we print:

| Item | VAT |

|---|---|

| Leaflets | Zero-rated |

| Brochures | Zero-rated |

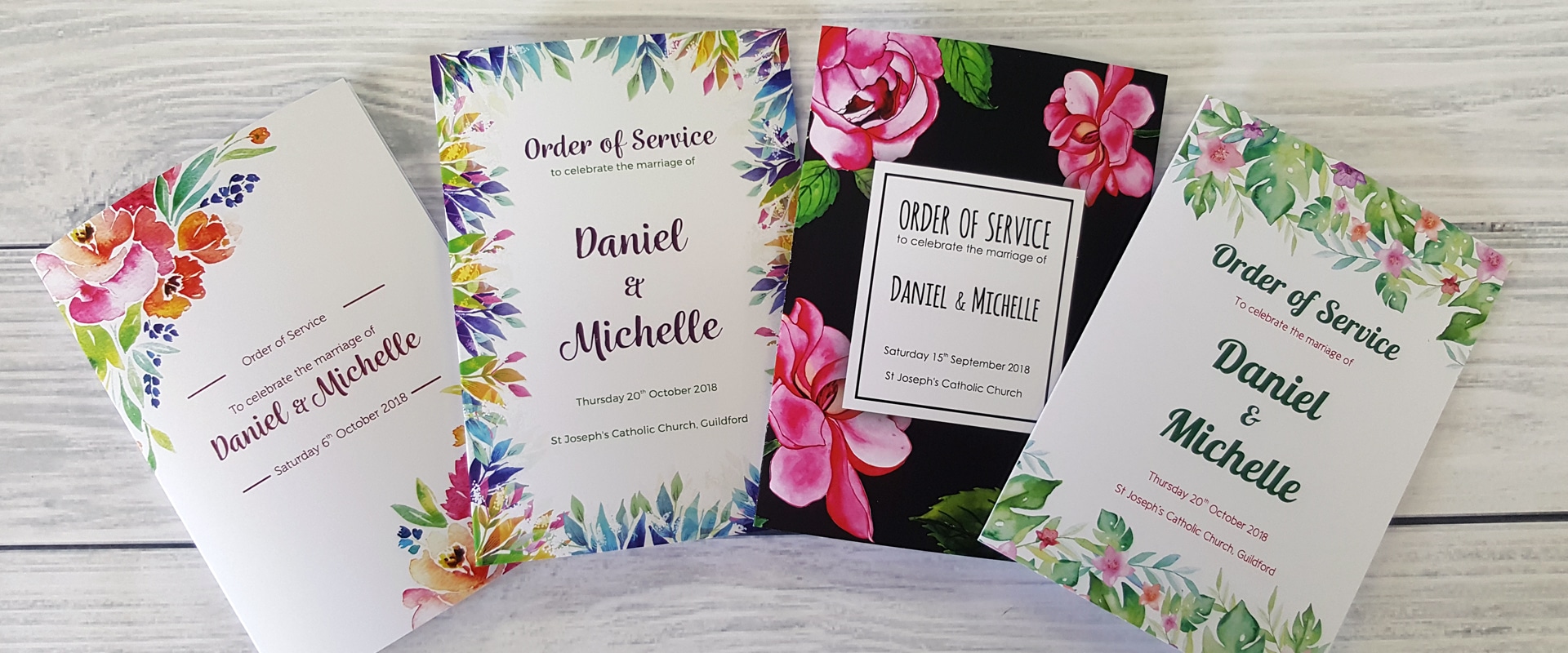

| Orders of Service | Zero-rated |

| Training Manuals | Zero-rated |

| Catalogues | Zero-rated |

| Price Lists | Zero-rated |

| Newsletters | Zero-rated |

| Books | Zero-rated |

| Magazines | Zero-rated |

| Forms | Standard-rated |

| Pads | Standard-rated |

| Posters | Standard-rated |

| Plans | Standard-rated |

| General documents | Standard-rated |

| Business Cards | Standard-rated |

| Stickers and labels | Standard-rated |

| Banners | Standard-rated |

| Signage | Standard-rated |

| Letterheads | Standard-rated |

| Stationery | Standard-rated |

| Invitations | Standard-rated |

| Restaurant Menus | Standard-rated |

Do Charities / Non-UK Companies have to pay VAT?

Yes, every business, charity and person is subject to the same rules. If the delivery is to a UK address, we have to charge VAT even if you are based abroad.

However please note that leaflets, newsletters and training manuals are zero rated anyway.